EURUSD

In this week's pricing of the EURUSD pair, both Eurozone and US-based fundamental economic data are expected to have an impact. If the Eurozone's annual Consumer Price Index (CPI) data for April, to be announced on Monday, aligns with expectations (2.2%), the market's reaction may remain limited. However, any deviation from expectations could lead to volatility in the Euro by revising market expectations regarding the European Central Bank's (ECB) monetary policy stance. On Thursday, weekly unemployment claims from the US, along with preliminary manufacturing and services sector PMI data for May and April's existing home sales, will influence the US Dollar's position in global markets. A potential slowdown observed in the PMI data, in particular, could be interpreted as a signal of loss of momentum in the US economy, putting pressure on the Dollar index. On the last trading day of the week, the first quarter Gross Domestic Product (GDP) growth data to be released from Germany is significant for the Euro's performance; an expected quarterly recovery of 0.2% could be seen as a supportive factor for the Euro. The new home sales data for April coming from the US on the same day may also have an effect on the pair's weekly closing.

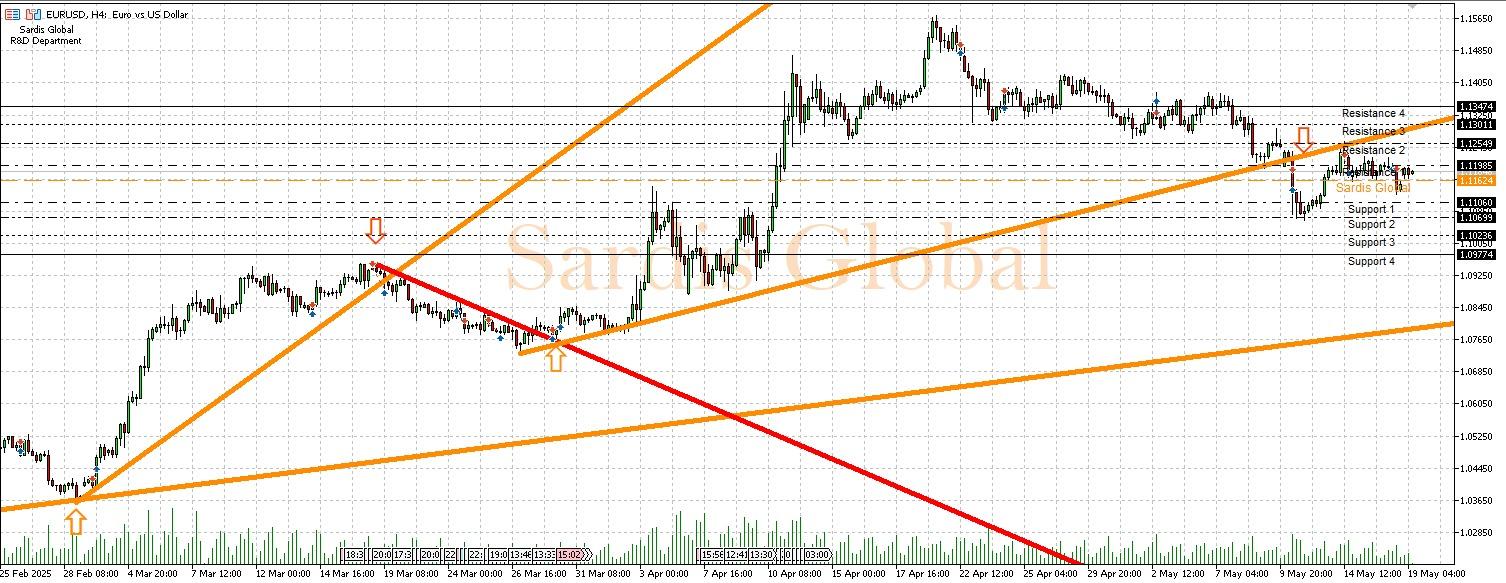

Support :

Resistance :