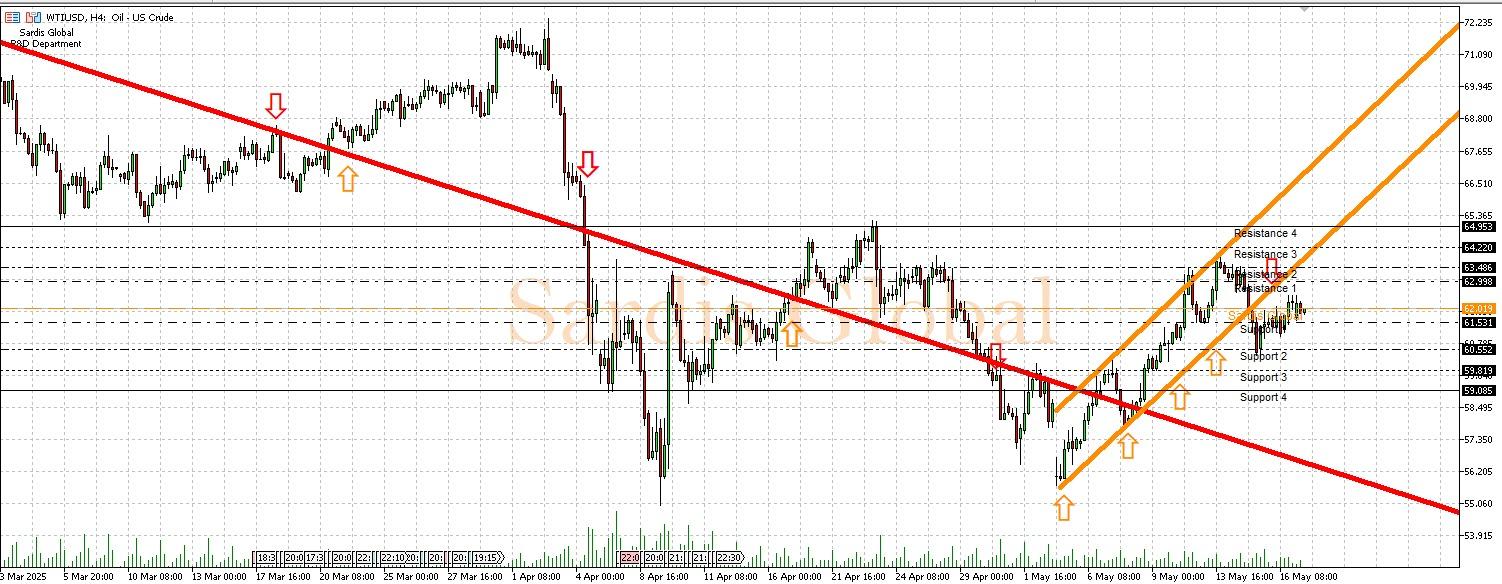

WTIUSD

This week, the weekly crude oil inventory data from the U.S. Energy Information Administration (EIA), which will be announced on Wednesday, will be the primary focus for crude oil prices. An increase in oil inventories above market expectations could raise concerns about a global supply surplus, putting downward pressure on oil prices, while a decrease in inventories or an increase that falls below expectations could be seen as a supportive factor for prices. Additionally, preliminary manufacturing and services sector PMI data from the U.S. on Thursday, along with GDP growth data from Germany on Friday, will provide important indicators regarding the trajectory of global economic activity and, consequently, oil demand. Signs of a slowdown in economic growth could negatively impact demand expectations, creating pressure on oil prices. The value of the U.S. Dollar in international markets will also continue to affect oil prices; a strong Dollar generally has a dampening effect on oil demand, while a weak Dollar could support oil prices.

Support :

Resistance :