XAUUSD

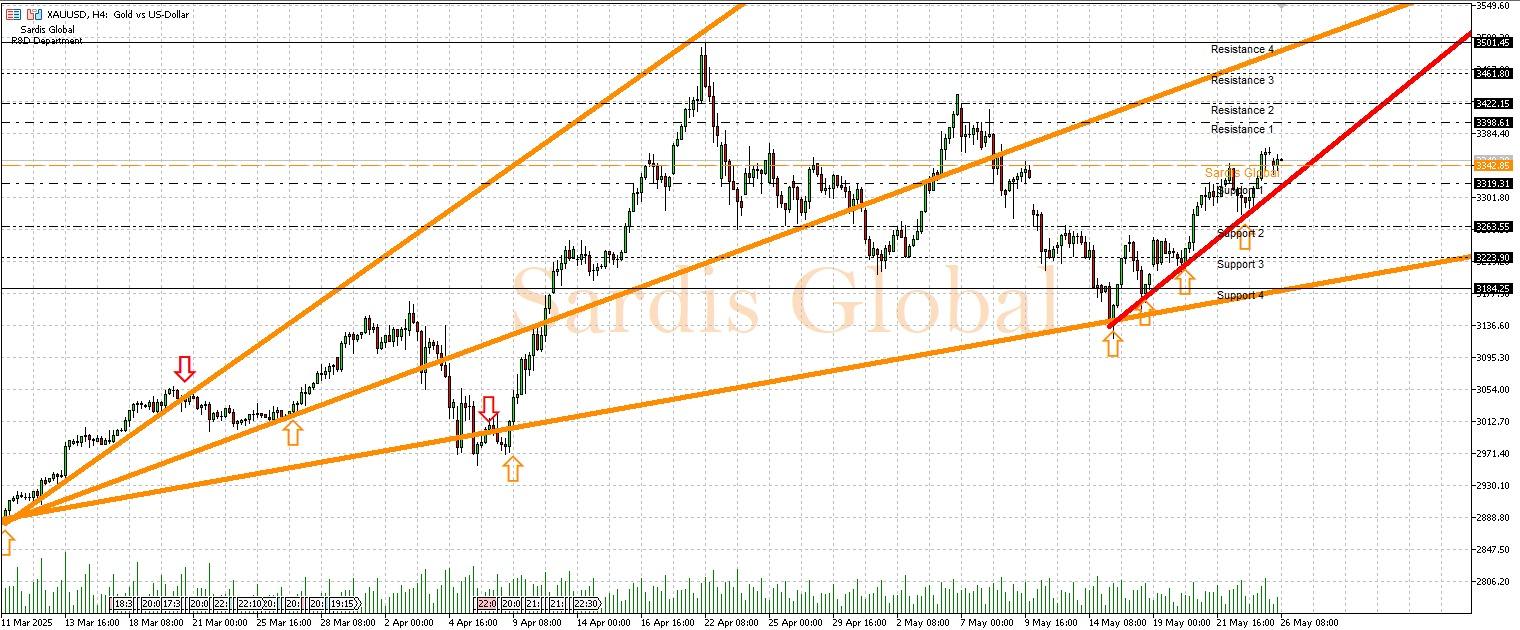

For gold, this week the focus of the markets will be on the FOMC meeting minutes coming on Wednesday and the US Core PCE data to be released on Friday, following Fed Chairman Powell's speech that took place on Sunday. These data points could be decisive for gold prices as they shed light on the Fed's rate hike path and inflation expectations. A hawkish Fed and weak US economic data (Tuesday Consumer Confidence, Thursday GDP) could strengthen the dollar, putting pressure on gold and pulling prices below the 3342.85 pivot level towards the support levels of 3319.31 (S1) and 3263.55 (S2). On the other hand, dovish Fed messages and US data that is more positive than expectations could increase demand for gold, leading to tests of resistance levels at 3398.61 (D1) and 3422.15 (D2). At the beginning of the week, low-volume trading may be seen due to holidays in the US and the UK.

Support :

Resistance :