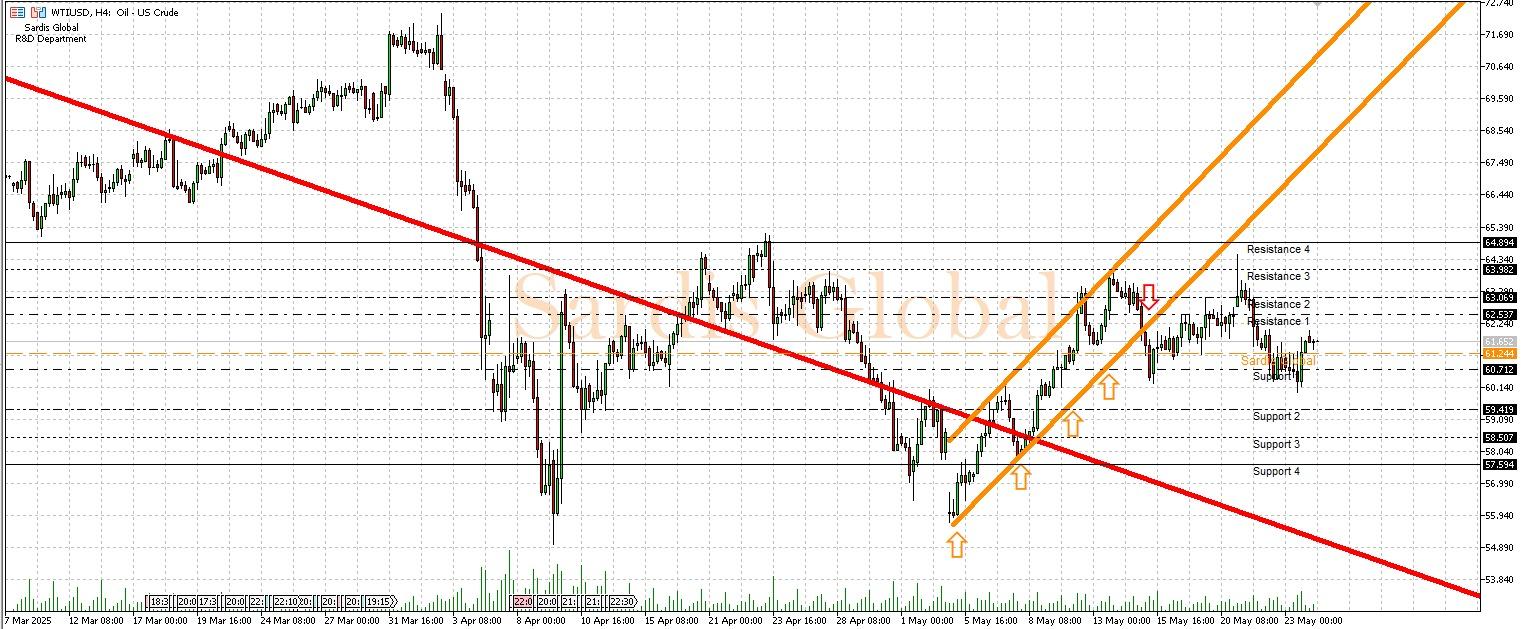

WTIUSD

Crude oil prices may be influenced this week, especially by the U.S. Energy Information Administration (EIA) crude oil inventory data to be released on Thursday. A higher-than-expected increase in inventories could trigger concerns about oversupply, putting downward pressure on prices, while a decrease in inventories could support demand outlook and push prices higher. Additionally, Thursday's U.S. GDP data and Saturday's Manufacturing PMI data from China will provide important signals regarding global economic growth and, consequently, oil demand. The Memorial Day holiday in the U.S. today might reduce trading volume in the oil markets. Technically, the pivot level is at 61.244. Strong demand signals and expectations of a decline in inventories could bring resistance levels of 62.537 (D1) and 63.069 (D2) into focus, while weak economic data and an increase in inventories could highlight support levels of 60.712 (S1) and 59.419 (S2). It appears that expectations have not yet taken shape and may impact prices after they are formed.

Support :

Resistance :