NDXUSD

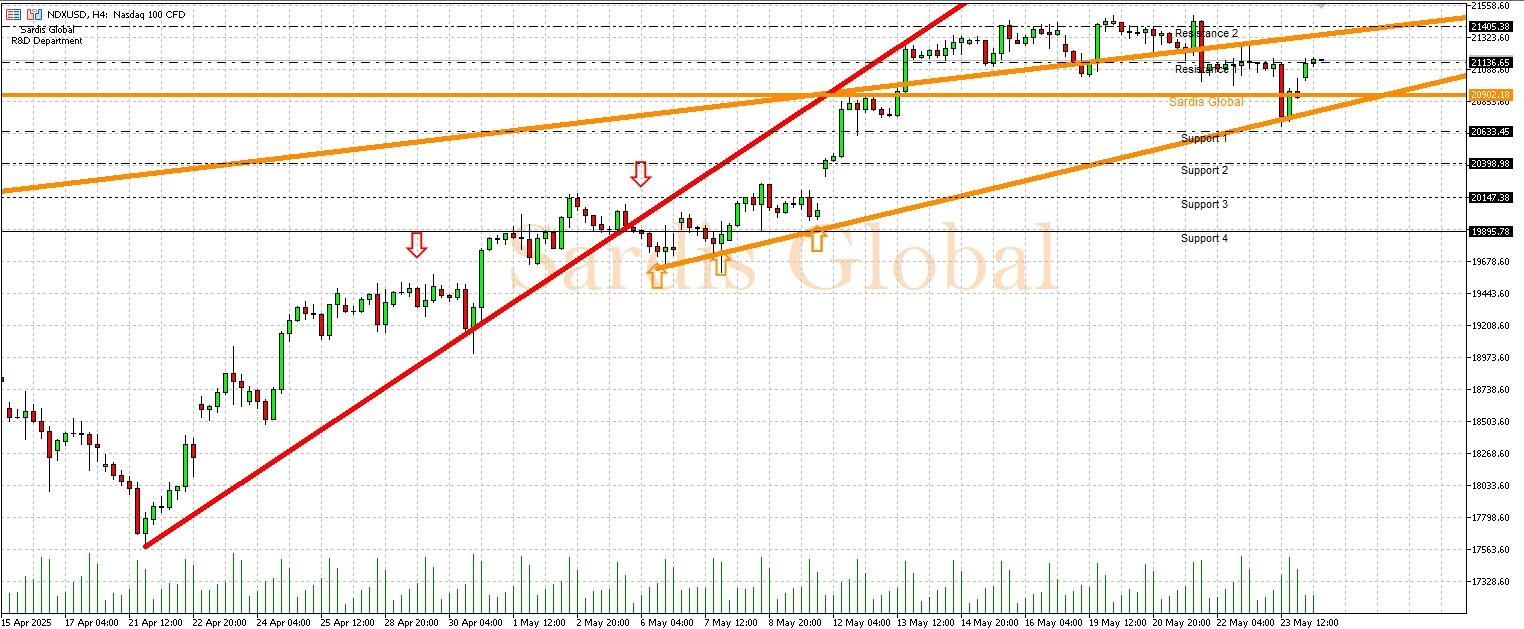

The Nasdaq Index will focus this week on the Fed's messages and U.S. economic data due to the sensitivity of technology stocks to interest rates. The reflections of Fed Chair Powell's speech on Sunday, the FOMC meeting minutes on Wednesday, and the Core Personal Consumption Expenditures (PCE) data to be released on Friday will carry significant signals regarding the Fed's monetary policy outlook. Hawkish FOMC minutes could strengthen expectations for interest rate hikes, putting pressure on the Nasdaq and pushing the index below the 20902.18 pivot level towards support levels of 20633.45 (S1) and 20398.98 (S2). Dovish messages, on the other hand, could increase risk appetite and target resistance levels of 21136.65 (D1), 21405.38 (D2), and 21656.98 (D3). Due to the Memorial Day holiday in the U.S., low trading volume is expected today.

Support :

Resistance :