XAUUSD

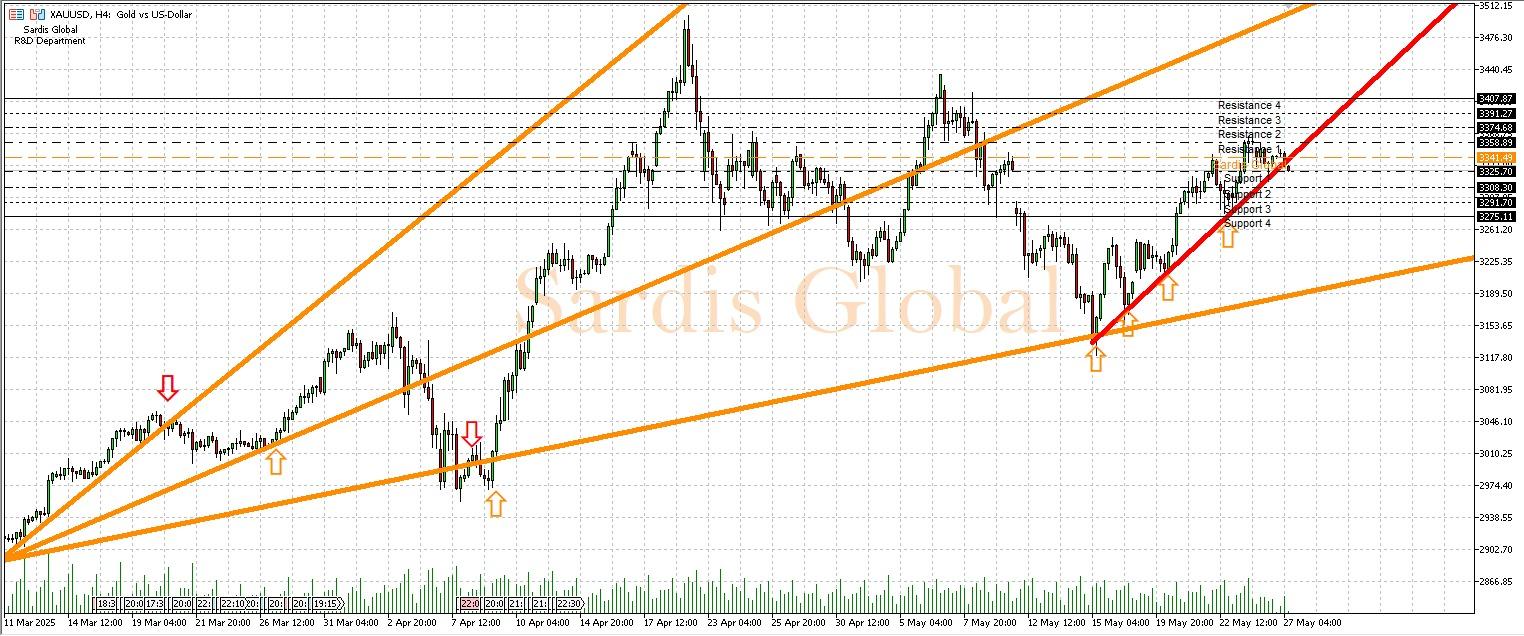

Gold showed a low-volume and calm trend on Monday due to the U.S. markets being closed. Throughout the week, following Fed Chair Powell's speech on Sunday, investors will focus on the FOMC meeting minutes to be released on Wednesday and the Core PCE inflation data to be announced on Friday. These developments could shape expectations regarding the Fed's interest rate policy, influencing gold prices. The current pivot level appears to be 3341.49. Hawkish messages from the Fed or PCE data coming in above expectations could strengthen the dollar, pulling gold towards the support levels of 3325.70 (S1) and 3308.30 (S2). Conversely, a dovish tone or weak economic data (Tuesday's CB Consumer Confidence, Thursday's GDP) could increase demand for gold, leading to tests of the resistance levels at 3358.89 (R1) and 3374.68 (R2).

Support :

Resistance :