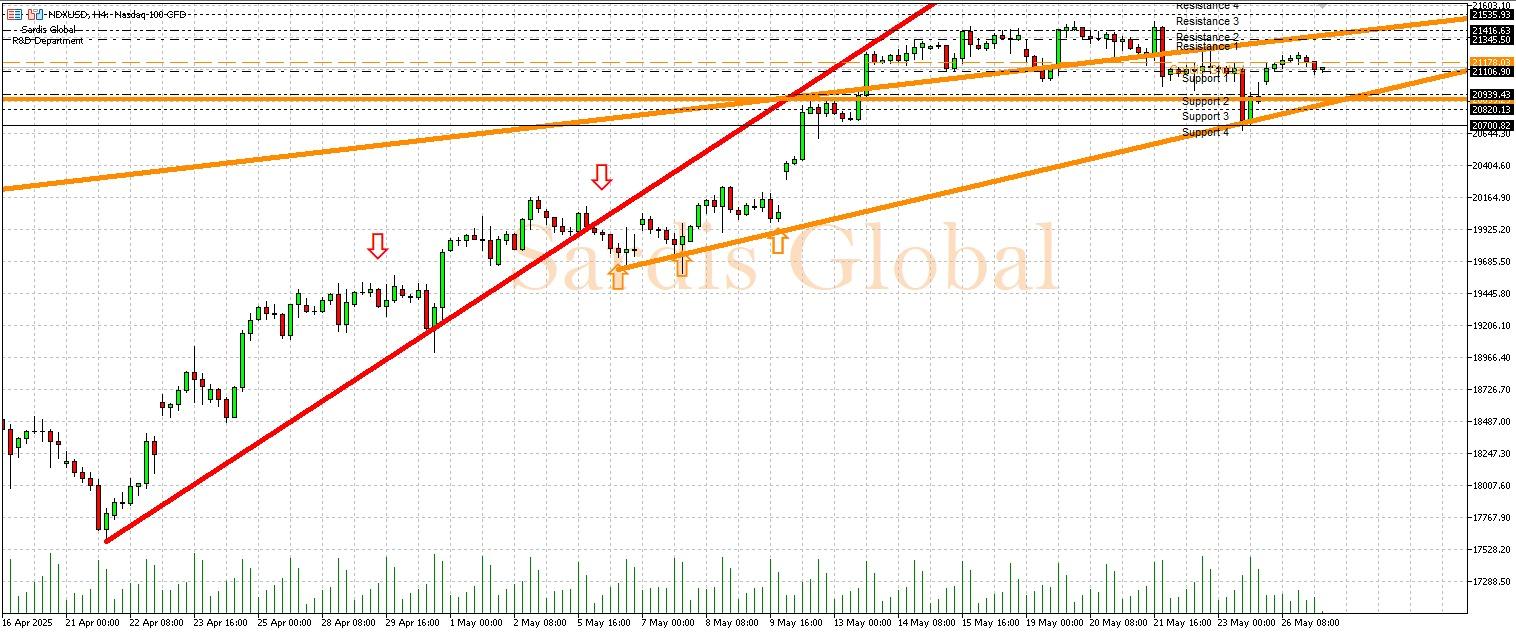

NDXUSD

The technology-heavy Nasdaq 100 index traded flat with low volume on Monday due to the Memorial Day holiday in the U.S. This week, the Fed's messages and U.S. economic data are crucial for the index, which is sensitive to interest rates. The FOMC minutes on Wednesday and the Core PCE inflation data on Friday will shape expectations for the Fed's next steps. The pivot level for the index is 21178.03. Hawkish FOMC minutes or strong inflation data could pressure the index towards support levels of 21106.90 (S1) and 20939.43 (S2). A dovish tone or better-than-expected economic data (Tuesday's CB Consumer Confidence, Thursday's GDP) could target resistance levels of 21345.50 (R1) and 21416.63 (R2).

Support :

Resistance :