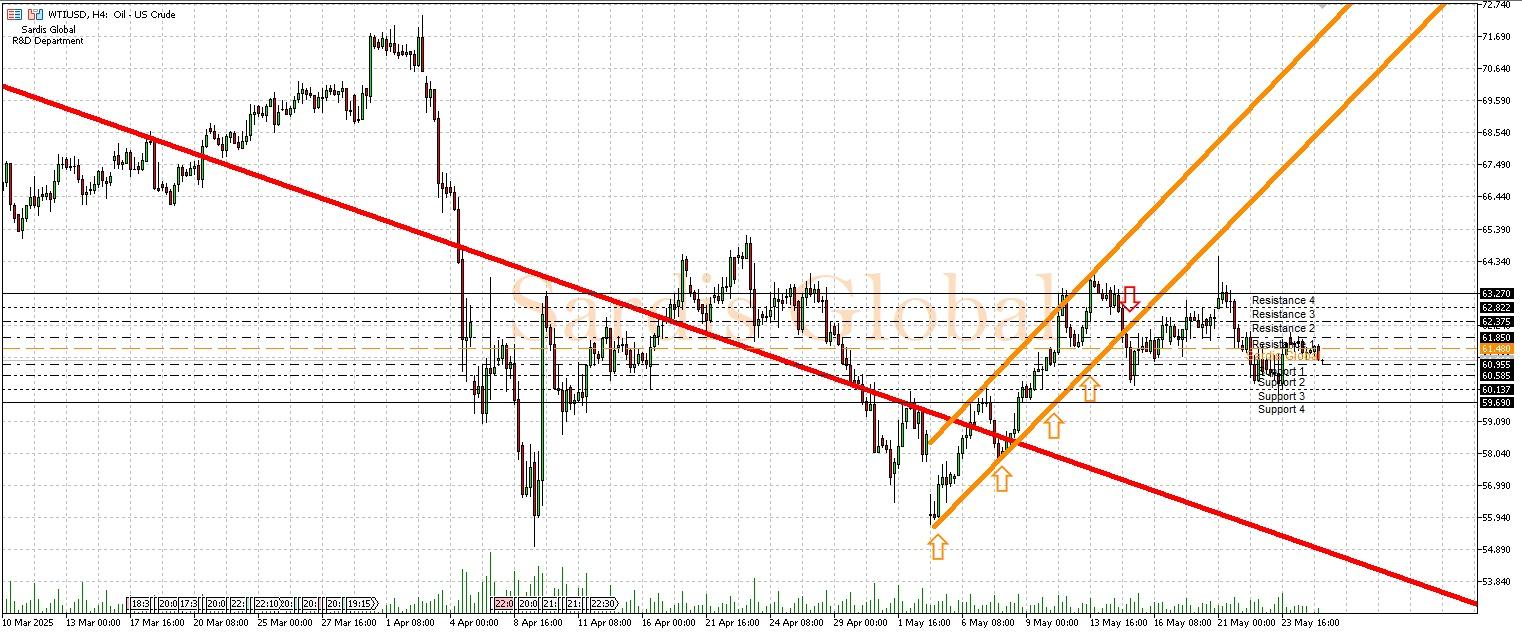

WTIUSD

Crude oil prices were away from significant market activity on Monday due to the Memorial Day holiday in the U.S. and traded with low volume. The most important data for oil this week will be the U.S. Energy Information Administration (EIA) Crude Oil Stocks, which will be announced on Thursday; changes in stocks (Previous: increase of 1.328M) will affect supply-demand dynamics. The U.S. GDP data announced on the same day and the Manufacturing PMI data from China to be released on Saturday (Expectation: 49.5) will also provide important indicators regarding global oil demand. The pivot level for oil at 61.480 will be monitored. An unexpected decline in stocks or strong demand signals could push prices to the resistance levels of 61.850 (R1) and 62.375 (R2), while an increase in stocks or weak global growth data could bring the support levels of 60.955 (S1) and 60.585 (S2) into focus.

Support :

Resistance :